|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

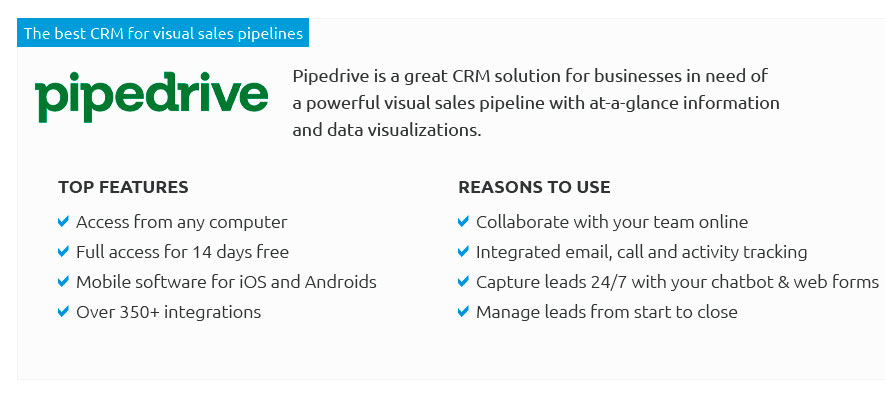

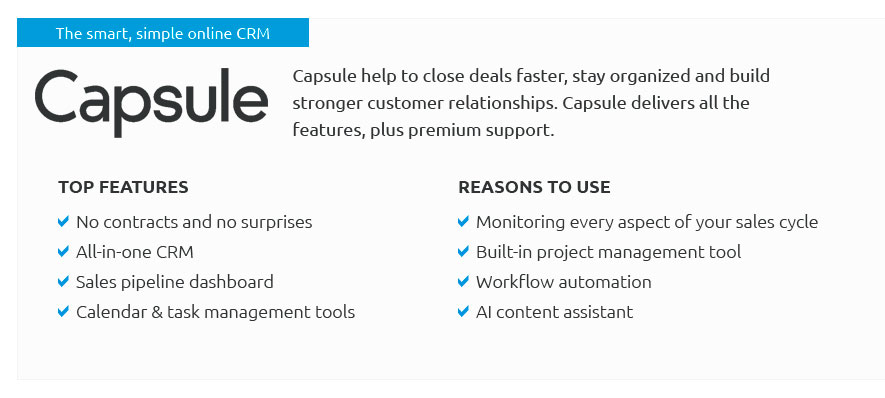

yxvzzp3dok Understanding Insurance CRM: A Comprehensive Beginner's GuideInsurance Customer Relationship Management (CRM) systems are specialized tools designed to help insurance companies manage customer interactions effectively. These systems streamline processes, enhance customer service, and ultimately boost sales and retention rates. What is Insurance CRM?Insurance CRM is a software solution tailored for insurance agents and brokers to manage and analyze customer interactions and data throughout the customer lifecycle. The goal is to improve customer service relationships, aid in customer retention, and drive sales growth. Key Features of Insurance CRM

Benefits of Using Insurance CRM

Implementing Insurance CRMSuccessful implementation requires careful planning. Many businesses use a lead generation strategy template to align CRM features with their business goals. Integration with existing systems, employee training, and ongoing support are critical to maximizing the benefits of CRM. Choosing the Right Insurance CRMSelecting the right CRM system involves evaluating the specific needs of your business. Consider factors like scalability, ease of use, and the ability to integrate with CRM database software that your company already uses. Factors to Consider

FAQs About Insurance CRMWhat is the main purpose of an insurance CRM?The main purpose of an insurance CRM is to improve customer relationship management by centralizing customer data, enhancing communication, and streamlining business processes, ultimately leading to increased sales and customer retention. How does insurance CRM help with regulatory compliance?Insurance CRM helps with regulatory compliance by providing tools and features that ensure data is handled in accordance with industry regulations, such as data protection laws and insurance standards. Can small insurance agencies benefit from CRM systems?Yes, small insurance agencies can greatly benefit from CRM systems as they help manage customer data efficiently, automate administrative tasks, and provide insights that can enhance customer service and sales strategies. https://www.salesmate.io/blog/crm-for-insurance/

6 Best insurance CRM software in 2025 - Salesmate is a versatile CRM that allows you to automate your entire customer journey. - Radiusbob is a platform that ... https://www.zoho.com/crm/solutions/insurance/

Disclaimer: Zoho CRM is not an out-of-the-box vertical CRM solution. It is an industry-agnostic CRM platform that can be customized to suit various industries. https://www.ezlynx.com/blog/posts/insurance-crm-vs-insurance-agency-management-system-whats-the-difference/

An insurance CRM system is software used to manage, track and organize an insurance agency's customer relationships and respond to customers' ...

|